Thousands of ĂŰčÖÖ±˛Ą families could qualify for financial aid to buy a house.

The Pathway to Purchase down-payment assistance program is now available to families who earn up to $90,000 a year to buy a home that costs less than $356,000 inside city limits.

Approved lenders can help families get a 30-year, fixed-rate mortgage and a second mortgage that can be used as a 10 percent down payment, up to $20,000, which can be forgiven after five years if conditions are met.

ĂŰčÖÖ±˛Ąans could get the lion’s share of $70 million available statewide, and more than 4,300 families potentially could be helped, said Michael Trailer, director of the ĂŰčÖÖ±˛Ą Department of Housing.

A fee added to the loan payments will fund a $500,000 rapid-rehousing program that could help about 100 homeless families find housing in Pima County, he said.

People are also reading…

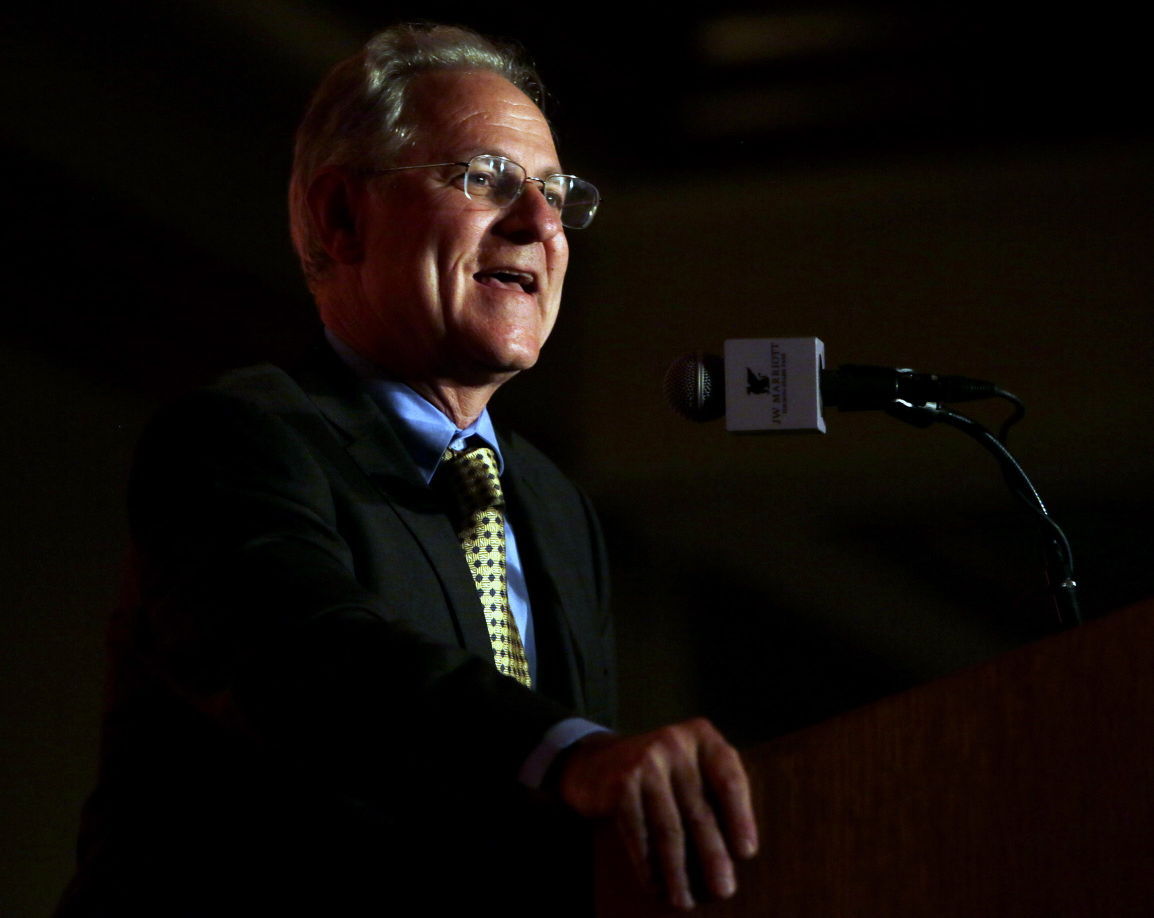

The ĂŰčÖÖ±˛Ą City Council approved the program Tuesday and Mayor Jonathan Rothschild launched the program Friday.

More information is available at .

Here’s what Rothschild said at the announcement event.

- “We have the infrastructure in this community to move this needle from 42 percent home ownership to where we ought to be as a community. … We’re not looking for 100 percent home ownership — home ownership clearly isn’t for everybody — but when you look at our numbers in the community, we can move this number a big margin if we do it in a way that brings everyone together.”

- “Homeownership stabilizes neighborhoods, helps families and individuals build financial security, and even has been shown to increase graduation rates, perhaps by improving residential security. Yet less than half of ĂŰčÖÖ±˛Ąâ€™s housing units are owner-occupied. Furthermore, many renters are struggling to afford rent when home ownership could be a better bet for them. So it just makes sense for us ĂŰčÖÖ±˛Ąans to try to increase homeownership by putting all available homebuyer assistance programs out in the market to good use.”

- “We’re in a very different place today than we were 10 years ago during the housing bubble. Dodd-Frank (Wall Street Reform and Consumer Protection Act), passed in 2010, prohibits the unsafe lending practices that led to the subprime mortgage crisis and the recession. In fact, a requirement of most of these programs is completing the HUD-approved pre-purchase homebuyer education workshop. … Homeownership is part of the American dream, but it’s a dream you have to go into with your eyes open, making sure you understand what you’re getting into.”

As more University of ĂŰčÖÖ±˛Ą students leave surrounding neighborhoods and move into the towers around campus, vacant homes in the area have increased steadily. In some neighborhoods the percentage of homes that are owner-occupied is less than 10 percent.

Click the pins for more information.