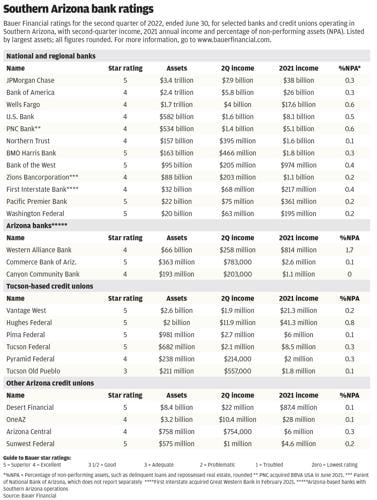

Banks and credit unions in УлшжжБВЅ and Southern УлшжжБВЅ maintained their financial strength in the second quarter, though a rise in consumer loan delinquencies nationwide is causing concern, according to the latest bank ratings from .

Most banks and credit unions operating in the УлшжжБВЅ area maintained their 5-star тsuperiorт or 4-star тexcellentт ratings from Florida-based Bauer, which has been rating the financial strength of financial institutions since 1983.

But nationally, Bauer said, while most federally-insured banks and credit unions remain solid, the percent rated 2-stars т тtroubledт or тproblematicт т is at its highest percent since the third quarter of 2018, including more than 3% of tracked institutions, a number last seen in the third quarter of 2014.

People are also reading…

While severe delinquencies remain low, Bauer said that for the first time in several years, both banks and credit unions are reporting upticks in early-stage past due loans, missing one or two payments.

тIt appears that consumers may have reached the tipping point between leveraging untapped value in their homes while rates were low and managing debt to income ratios as (interest) rates rise,т said Karen Dorway, president of Bauer Financial.

Old and new names

Southern УлшжжБВЅ banks and credit unions remain strong, for now.

УлшжжБВЅ-based rose to 4 stars from a 3-ТН star тgoodт rating after posting a $203,000 profit in the second quarter.

Canyon, which is mostly owned by a Texas investor group, has worked its way back to financial health after being placed under a consent order by the Office of the Comptroller of the Currency in 2013, and it had been rated as low as 1 star, or тproblematic,т by Bauer in 2016.

The consent order was lifted last year, and Canyon is one of the most well-capitalized banks in the state, with no тnon-performing assetsт т delinquent loans and foreclosed real estate т reported in the second quarter.

УлшжжБВЅ-based maintained its top, 5-star Bauer rating and posted a $783,000 profit in the second quarter.

Commerce also was under a regulatory order to raise capital a few years ago and had a тzeroт Bauer rating in 2016, but the order was lifted in 2017 after the bank raised $13 million in new capital from local investors.

The only other bank to see its Bauer rating change in the second quarter was First Interstate Bank, which arrived in УлшжжБВЅ in February after merging with Great Western Bank, and saw its Bauer rating fall to 4 stars, from 5 stars in the prior quarter.

Based in Billings, Montana, First Interstate Bank has nine locations in УлшжжБВЅ, including one in УлшжжБВЅ at 3002 N. Campbell Ave.

First Interstateтs name and logo are familiar to long-time УлшжжБВЅns, as the former Los Angeles-based First Interstate Bancorp was a major player in the state before it was acquired by Wells Fargo in 1996.

The bank now operating as First Interstate had operated branches in Montana and Wyoming under a franchise agreement with the former First Interstate Bank in the 1980s, then licensed the name and logo after the Wells Fargo acquisition.

PNC settles in

Another relatively new name in the УлшжжБВЅ-area banking market is , which completed its acquisition of BBVA USA from it Spanish owner, Banco Bilbao Vizcaya Argentaria, in June 2021.

PNC, which has 13 branches in Southern УлшжжБВЅ, maintained it 4-star Bauer rating in the second quarter, posting a profit of $1.4 billion.

Based in Pittsburgh, PNC Bank has assets of $534 billion and operates more than 2,600 branches in 27 states and the District of Columbia.

While PNCтs name is relatively new around УлшжжБВЅ, BBVA USA was formerly BBVA Compass and was previously owned by Compass Bancshares, which entered the УлшжжБВЅ market in 1998 with its acquisition of УлшжжБВЅ Bank. BBVA acquired Compass in 2007.

While the name has changed, the PNC operation should remain familiar, since PNC kept BBVAтs УлшжжБВЅ and УлшжжБВЅ operations intact including employees and management.

Longtime local banker Mark Mistler was kept on board as PNCтs regional president for УлшжжБВЅ and Southern УлшжжБВЅ, and PNC kept BBVAтs roughly 150 employees in the region, he said.

тWe feel very fortunate т PNCтs a great bank,т said Mistler, who grew up in УлшжжБВЅ and joined Compass in 1999 after working for Valley National Bank and Bank One.

тPNC really liked the business we had in УлшжжБВЅ, and so weтre looking to grow the business and not detract,т Mistler said.

Mistler cited PNCтs тMainstreet banking model,т a local focus that includes keeping a regional president in most of the major markets where it operates.

тWeтre the fifth largest commercial bank in the United States, but because of our structure, we can deliver like a smaller regional or community bank,т Mistler said, noting that a core group of leaders at the local operation have worked together for some 30 years.

Mistler noted that PNC committed a half a billion dollars in 2004 to its тGrow Up Greatт initiative to support early childhood education and development. In УлшжжБВЅ, PNC is working with El Rio Health as its first partner in the program, Mistler said.

Another PNC program benefiting УлшжжБВЅ is its Community Benefits Plan, which was launched in January.

The initiative will provide $88 billion nationwide in loans, investments, and other financial support to boost economic opportunity for low- and moderate-income individuals and communities, people and communities of color, and other underserved individuals and communities over a four-year period.

тThey have a big commitment to the local communities they serve, which is great for our community with УлшжжБВЅ as kind of a mid-size city, you always hope that with any major bank or other big company acquisition that they continue to support the community,т he said.

Contact senior reporter David Wichner at dwichner@tucson.com or 520-573-4181. On Twitter: @dwichner. On Facebook: