Defense contractor Raytheon Co. reported strong fourth-quarter sales and earnings and a record backlog of business Thursday as higher military spending continued to buoy the company.

The Massachusetts-based parent of УлшжжБВЅ-based Raytheon Missile Systems posted fourth-quarter net sales of $7.8 billion, up 6.5% from fourth quarter 2018, while net income from continuing operations rose nearly 8% to $3.16 per share.

The results topped analystsт expectations of earnings of $3.11 per share, but Raytheonтs sales fell short of Wall Streetтs forecast of $8 billion in sales, according to Zacks Investment Research.

Shares in Raytheon, which is expected to complete its pending merger with United Technologies Corp. early in the second quarter, fell $1.22, or about one-half percent, on Thursday to close at $226.10 in trading on the New York Stock Exchange.

People are also reading…

For all of 2019, Raytheon reported net sales of $29.2 billion, up 7.8% from 2018, while net income soared more than 17% to $11.92 per share.

Raytheon Missile Systems posted fourth-quarter net sales of $2.3 billion, up 1% from the same period in 2018, while operating income jumped 9% to $297 million.

For the full year, Missile Systems had net sales of $8.7 billion, up 5% mainly on higher sales on classified programs, but annual operating income fell 1% to $959 million.

The decline in operating income last year was primarily due to lower net program efficiencies, partially offset by higher volume, the company said.

During the fourth quarter, Missile Systems booked nearly $1.6 billion in sales on a number of classified contracts, $1 billion for its for Standard Missile-6 multi-mission for the U.S. Navy; $893 million for the Standard Missile-3 ballistic-missile defense system for the Missile Defense Agency and $795 million for its Advanced Medium-Range Air-to-Air Missile for the U.S. Air Force, U.S. Navy, and international customers.

Among its other business units that report operating results, Raytheon Integrated Defense Systems posted an 18% increase in fourth quarter net sales, to $2 billion, mainly on major international sales of Patriot missile-defense systems and a contract for an air and missile defense system for the U.S. Navy.

Raytheon and United Technologies shareholders have approved the merger of the two companies to form Raytheon Technologies Corp., which would create the worldтs second-largest aerospace and defense company after Boeing Co.

The deal is contingent on United Technologiesт successful spinoff of its Carrier heating, ventilation and air-conditioning business and its Otis Elevator subsidiary and is subject to federal anti-trust approval, which is expected after the Defense Department said it had few concerns about the merger.

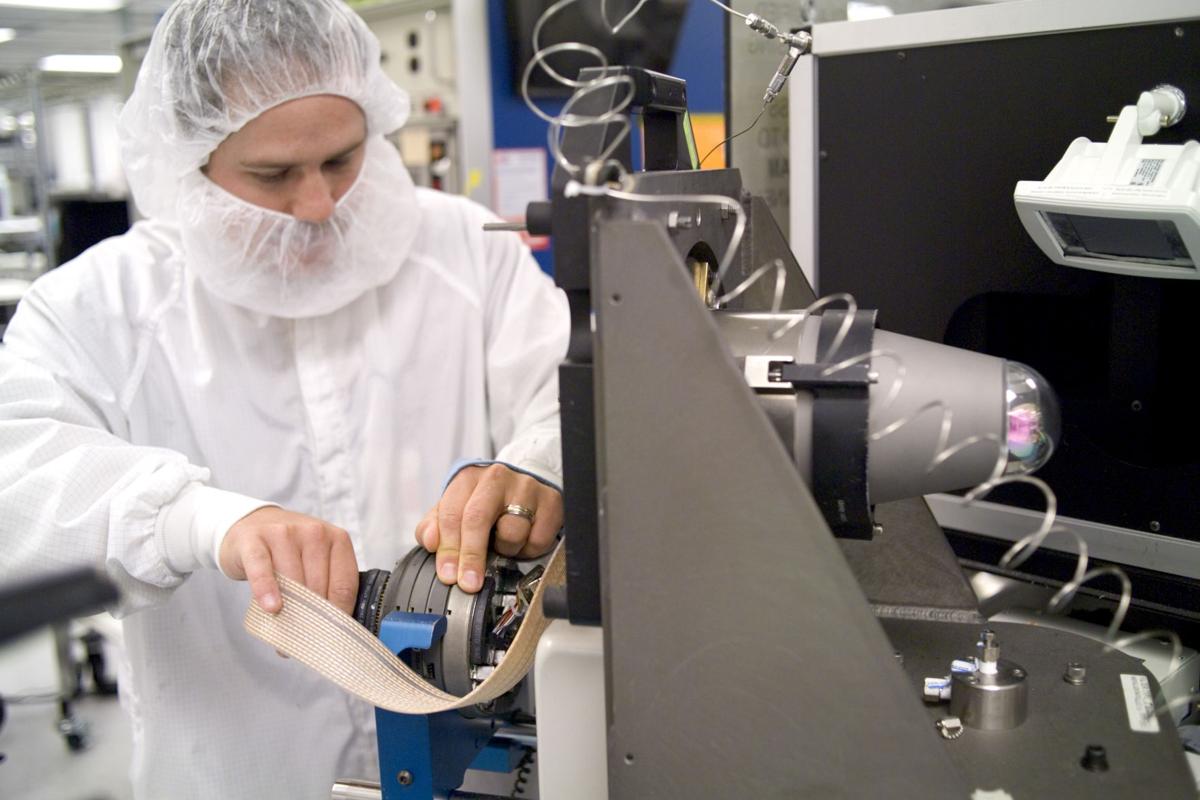

Raytheon Missile Systems is Southern УлшжжБВЅтs biggest employer with about 13,000 local employees as it continues to expand to meet demand for its weapon systems.

Under the merger plan, Missile Systems would be combined with Raytheonтs Integrated Defense Systems, which is based near Boston, to form the new Raytheon Integrated Defense and Missile Systems.

Missile Systems President Wes Kremer has been named to head the post-merger business unit but the company has not announced the merged unitsт headquarters location.

Contact senior reporter David Wichner at dwichner@tucson.com or 573-4181. On Twitter: @dwichner. On Facebook: