Shareholders of Raytheon Co. and United Technologies Corp. on Friday overwhelmingly approved UTCтs acquisition of Raytheon in a deal billed as a тmerger of equals.т

The vote keeps the transaction on track to close in the first half of 2020, subject to customary closing conditions including required federal regulatory approvals, and completion of United Technologiesт spinoff of its Otis and Carrier businesses, the companies said.

The merger combines UTCтs aerospace businesses, comprised of Collins Aerospace and engine maker Pratt & Whitney, with Raytheonтs defense business including УлшжжБВЅ-based Raytheon Missile Systems т Southern УлшжжБВЅтs largest employer т to create Raytheon Technologies Corp.

The merged company, which will be headquartered in the Boston area, will have initial annual combined revenue of about $74 billion, making it the second-largest aerospace and defense company in the U.S. after Boeing.

People are also reading…

тTodayтs vote reflects a significant step on our path to unite two world-class companies with complementary technologies and supports our view that this merger of equals will create additional growth opportunities while delivering benefits to our shareowners, customers and employees,т said Raytheon Chairman and CEO Tom Kennedy.

Despite early opposition from some activist shareholders who said the deal would add little value, approval was expected and got a boost when influential Institutional Shareholder Services recommended approval in September.

The deal still needs to clear an anti-trust review by the Justice Department, in consultation with the Department of Defense, but a senior Pentagon official said in August there appeared to be тno major concernsт that would derail the deal.

Company executives have said they do not expect to run afoul of anti-trust laws since the companiesт product lines have little overlap, with Raytheonтs businesses focused on weapon systems and defense electronics like radars and United Technologies making jet engines and aircraft avionics.

Under the merger plan, УлшжжБВЅ-based Raytheon Missile Systems would be combined with Raytheonтs Integrated Defense Systems unit, which is based near Boston, to form the new Raytheon Integrated Defense and Missile Systems.

The new headquarters of that combined business unit will not be announced until the deal is completed, the companies said in regulatory filings.

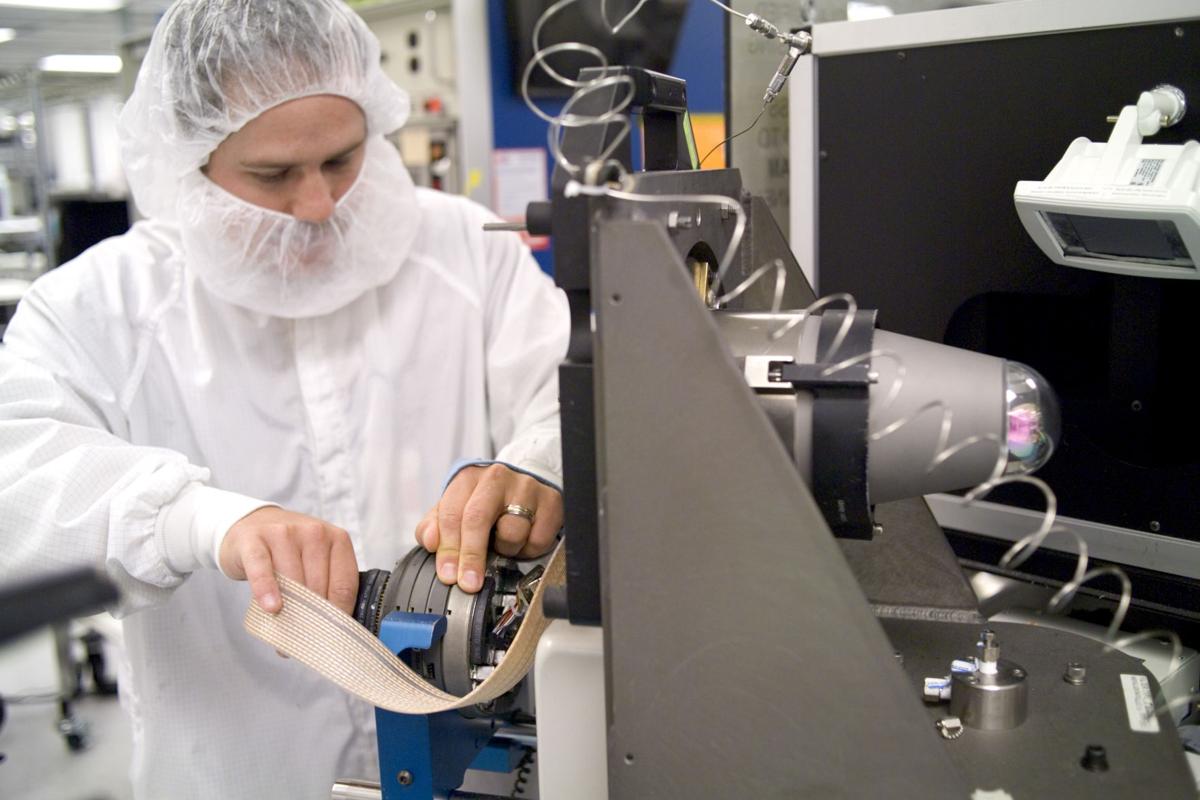

Missile Systems employs more than 13,000 workers in the УлшжжБВЅ area, making weapons including the Tomahawk cruise missile, the Sidewinder air-to-air missile and the Standard Missile-3 series of ballistic missile interceptors.

Another business unit will be formed from Raytheonтs Space and Airborne Systems and Intelligence, Information and Services units, and UTC Mission Systems and Raytheonтs Forcepoint cybersecurity unit.

Together with two of UTCтs current businesses т engine maker Pratt & Whitney and Collins Aerospace т they will form the four main business units of the merged company.

Under a deal valued at about $120 billion, Raytheon shareholders will get 2.3348 shares in the combined company for each Raytheon share.

Upon completion of the merger, United Technologies shareholders will own about 57%, and Raytheon shareholders will own approximately 43% of the combined company.

Contact senior reporter David Wichner at dwichner@tucson.com or 573-4181. On Twitter: @dwichner. On Facebook: .